How to lose money in Defi

Dumb shit with Save.Finance permissionless pools and meme coins

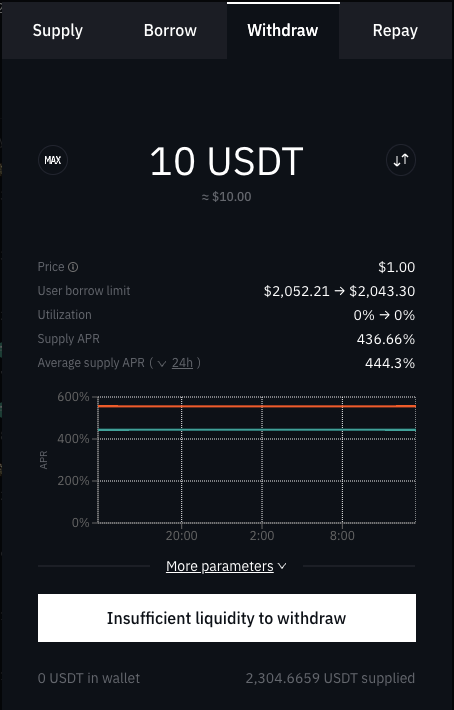

So I ought to write this one up with the tag dumb-shit-i-knew-as-i-was-doing-it. Basically I dumped $2300 in a Save.Finance permissionless pool – went out of my way to to it – and immediately lost my money. It's not that there's anything inherently wrong with Save, (formerly Solend), this was a pool set up around a shitcoin meme coin, and even if it wasn't set up as an obvious scam, it's something I should not have been messing with at all.

It was a genuinely stupid thing to do, and while it wasn't the most I've lost on one one of these YOLO experiments, it sure is about the closest I've come to an self-own in a while.

Let's dive in.

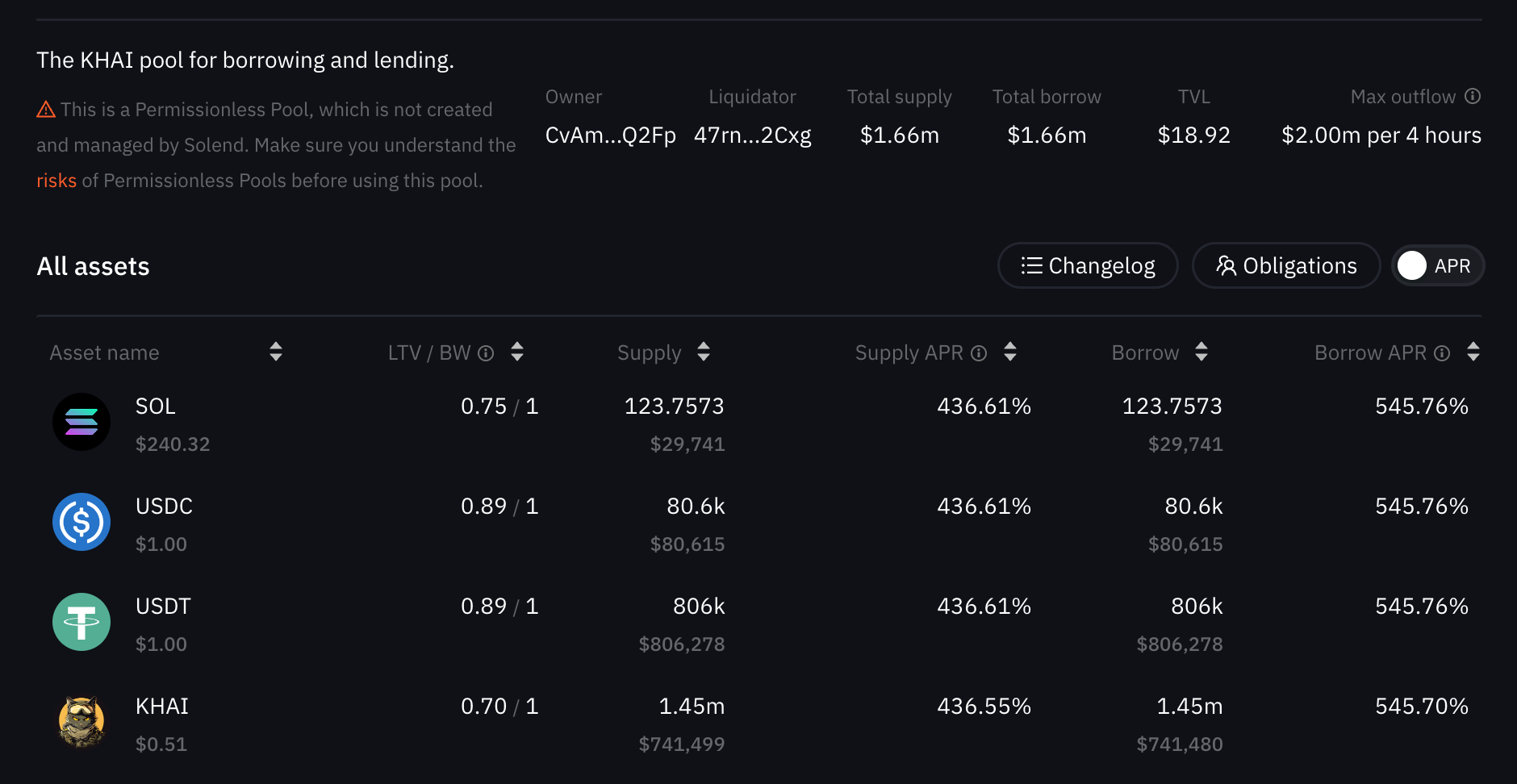

If you head over to DefiLLama and look at their stablecoin pools by APY, you'll see the KHAI Pool listed in the number two spot. We picked this one because the other is on BASE, and we had funds on Solana already.

Now, you can ignore the WATCH OUT on Save here, as we moronically did, but the real killer here was the drop in liquidity – the blue line on the graph – around November. This is indicative of a

locked pool, which we'll explain shortly.

First off, finding this pool was a bit of a challenge. Save is in the midst of a rebrand from Solend, so the UX and docs pages are not showing up, and so far I haven't been able to find this pool on the new site, just the old one.

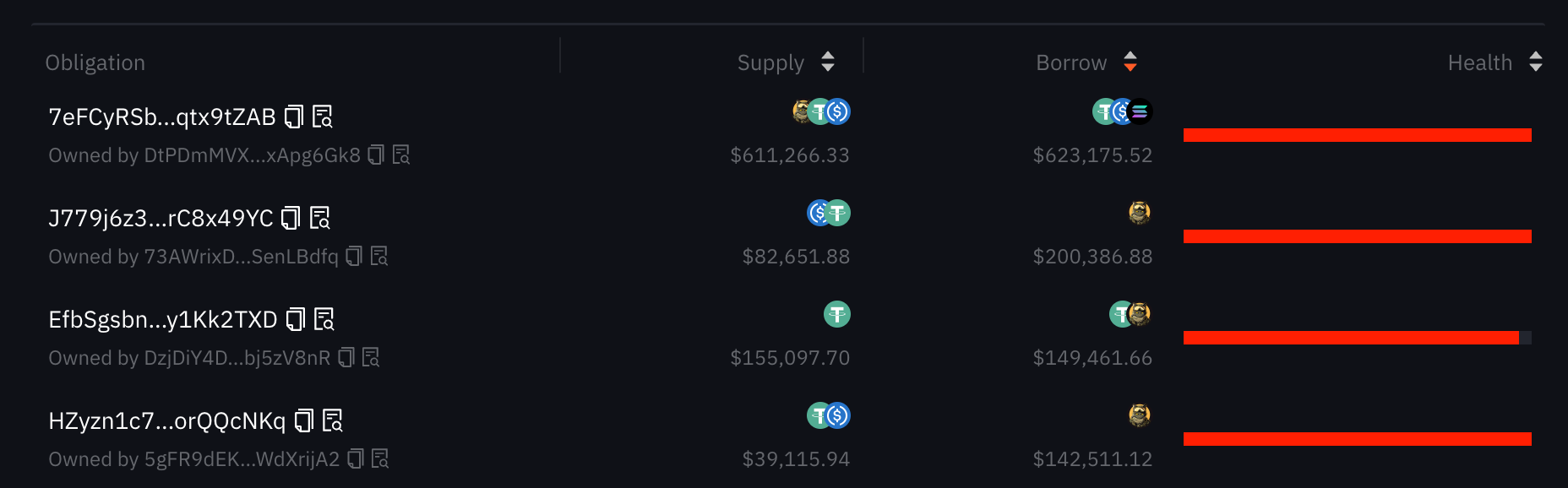

First off, I don't know how DefiLlama considers this a stablecoin pool, as WTF is KHAI? Aside for the moment, you can see that the supply and borrow rates are equal. That's why the APR is so high. The way these pools work is that the rates go up as the borrow ratio gets higher and higher. The problem here is that the pool has been built with this KHAI token, and is mainly a vehicle for KHAI holders to borrow the other assets without selling their tokens. Save/Solend is also also intended as a way for people to short KHAI, by putting up collateral, borrowing tokens, and dumping them. Of course the idea is that you have to repay the loan at some point, but that's an assumption that no longer holds true here, as we can see from a snippet of the pool's obligations below.

Now the way DeFi lending platforms are supposed to work, on the borrower side, is that you want to provide an asset, such as KHAI, and borrow one of the other coins: SOL, USDC, or USDT. So you have $10k of your memecoin that you deposit, and then you can borrow against it. The amount you can take is based on the utilization rate, or Loan To Value (LTV), which is traditionally 50%, but can be higher. Here it's 70%. Save has other levers the pool owner can use, such as a multiplier, but enough of that for now. If your LTV breaches this threshold, you're position is supposed to be be liquidated, your coins sold off and returned to balance the pool. Say that you had $10k of KHAI, borrowed $7K of USDC, then the price of KHAI tanks 50%. Now you've got $7k of debt against $5k of asset. No-no, the protocol should liquidate you as soon as that LTV breached the liquidation threshold.

The reason it didn't here, is that the owner of the pool needs to designate a liquidator account. This ideally should be a bot that can run 24-7, but I suppose it could be someone with a wallet. IDK, but the point here is that person is not doing their job. Or, you know, it's by design.

After I realized my mistake I hopped on the Save and KHAI Discords. The only mentions of it on by the KHAI team is that they didn't set it up, of course. The few mentions on the Save Discord tells a bit more.

Apparently whitelisted liquidators are a big no-no. If the liquidator doesn't perform its duty, bad debt piles up, people don't pay their debts, which prevents withdrawals, and the pool locks. Apparently the same thing happened recently with something called TRUNK that was operating in bad faith, but there was some discussion whether the KHAI pool owner was as well. The problem for them right now is that liquidating accounts will force KHAI to dump, and now everyone's trying to rush the exits so it prevents the pool from getting in good health.

Will a massive KHAI pump restore this to good health? I don't know. Can I get my cash out? Maybe, but I'd probably have to write a bot or script to notify me the second it does. Not likely, I'll just have to write this off as a big fat L for the start of the bull run. I'm not going to sweat this much, the funds were in a tax-deferred retirement account, so it's not like I was going to see it for another forty years anyways. Plus I was coming off of a much larger win in that account, and this amount is well within my risk tolerance. Still, I'm not going to make excuses for putting such a large amount in something I didn't take the time to understand.

I lost ten times this amount in hacks last cycle, it's a part of the game, but throwing good money away in a dumb move like this is not something I want to replicate again. I'm going to consider this a refresher in risk management.

Generally speaking, with most of the mature DeFi protocols, you can expect to get about 10% APY on your stablecoin assets, and much less on your native tokens or wrapped bitcoin. No one wants to borrow them, they're routinely used as collateral against USDC/USDT pairs. Over the last couple cycles, it's been profitable to hold BTC against a high debt such as that, as BTC's annualized gains year makes 10% seem like a small price to pay. As long as you're comfortable with the contract risk, and manage your TVL effectively, one can basically never pay the loan back. Bitcoin's patented Number Go Up (NGU) technology takes care of that. The problem here being that you can't do this with native bitcoin without trusting a third party or utilizing a wrapped BTC product. wBTC seems to have held up over the last couple cycles, and Coinbase's cbBTC might have some use here as well.

Chasing yield is of course risky; I was recommending BlockFi last cycle, and getting 8% or whatever on USDC was great until they blew up. I made it out of that, but I had friends who got caught up in that, FTX, or Voyager implosions, so part of my risk management plan is to keep most of my net in native tokens, and spread things around on a risk adjusted basis. I did this last cycle to set aside a years worth of salary, and it was a lot of work to vet. We've got some essays about that in the archives that we may revisit as we get warmed up and start doing more research. I generally don't chase meme coins, I will invest in ecosystems and platforms, but there's nothing on my radar currently that fits the bill, as I have not been paying attention for the last year.

Next time I will show you a strategy that I used to farm BTC over the last four years that has paid off handsomely (so far). I'll be re-assessing it as a strategy moving forward, and I'll show you how I'm calculating the risk and rewards.