Steady as she goes

Patience, Planning, and the Price of Bitcoin

There is nothing I can tell you about times like these, when BTC is making ATH after ATH. It consumes my attention, and it's hard to get anything done with that in the back of my mind. I've occupied the last couple days with painting my dining room, getting ready to host Thanksgiving next week. When I went to bed last night, BTC was trending just under 95k, had been ten dollars under it for several candles on the 30m chart, then finally touched eight dollars over and had fallen back when I decided it was time to put the phone away and go to bed. I got up and checked as soon as I rolled out of bed. It was up 3k, and has been wobbling around all day, currently hovering near the top.

Four years ago I was watching these market dynamics play out. My bags have grown over the years to the point where a half-year's salary comes and goes on a daily basis. It's been ongoing 20-30k a day or more with no effort on my part. I've been sitting on my hands for eighteen months now, waiting for this moment. You could say we were promised 100k last cycle, and now that we're within pouncing range I have become filled with what I can only describe as validation.

The last eight months of market consolidation, since the halvening in April, has been one of the toughest in my life. No income, and the deep belief that a bull market was coming prevented me selling off more than was absolutely necessary to cover a modest standard of living and pay the bills. Let's just say that it's put a strain on our marriage as well.

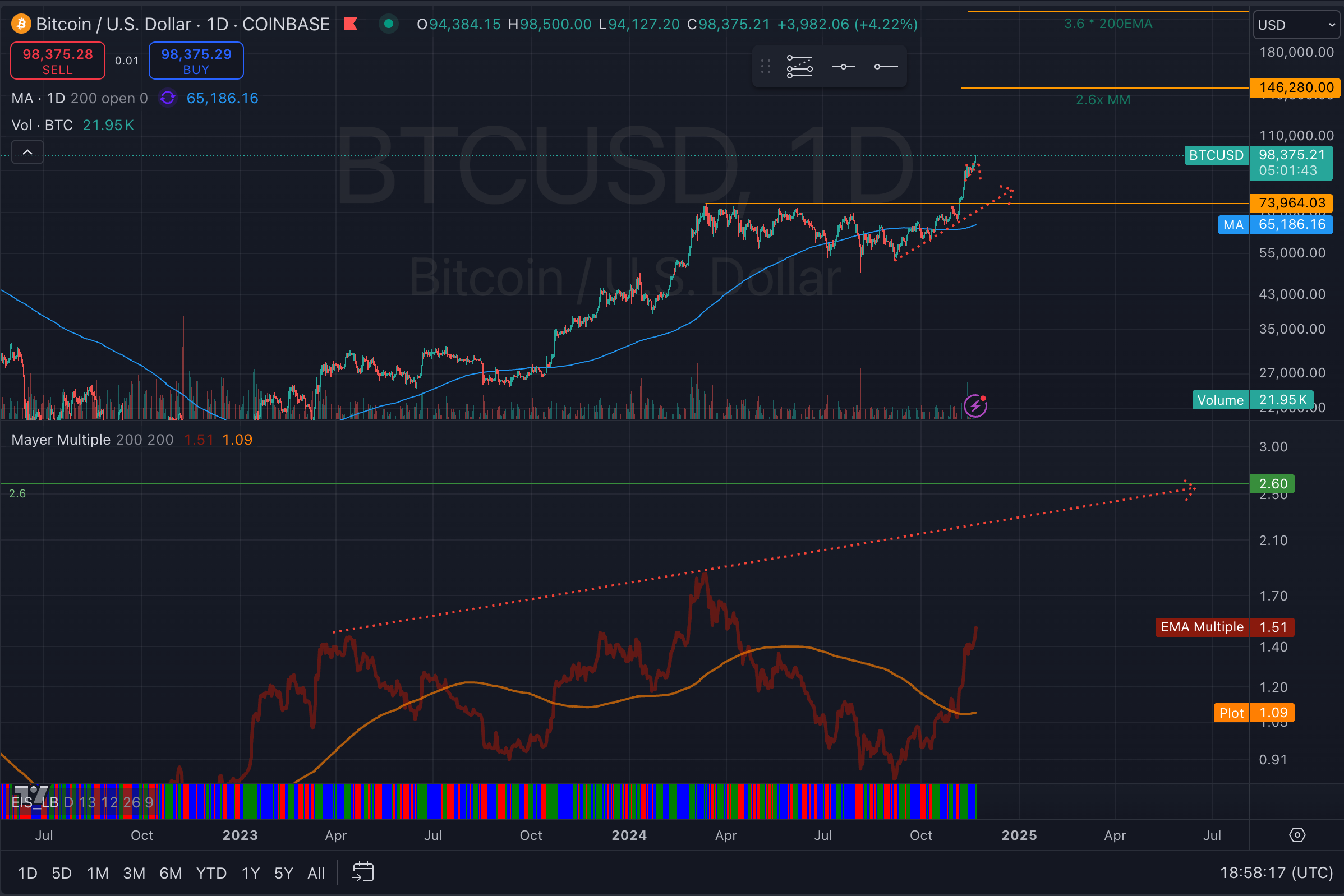

While I think "technical analysis" is mainly reading tea leaves, I think charts are useful for gauging trends and planning. Here's my current mess of a chart:

The top pane is BTC price, the bottom is the Mayer Multiple, the current price divided by the 200-day moving average (blue line, top chart). Some people might use an EMA, but no difference here. We're tracking the 200d MA of the multiple as well. If I zoom out the the five year and show you earlier blow off tops, you'll see peaks at the 2.6 and 3.6 levels, so I've long kept these numbers on the upper chart (upper right orange horizontal lines) to give me a sense of where things have historically gotten crazy. As you can see the lower bound is 146k, the upper at 230k, if we manage to hit these numbers in the next year I'll probably take a long vacation. Problem is that it's a moving target, and the faster the BTCUSD MA moves, the higher those levels get. We'll see

If you pay attention to the lower graph, you'll see that the MM EMA has just started creeping upward. And PA has a ways to go before we match the run that ended last May. A friend asked me if I considered that the beginning of the bull, and I said no, that I considered it a return to normalcy. But generally speaking, my intentions are to sell when the MM is moving upward, above it's MA, and that should give me some cash reserves for when things start dumping again in another year and a half.

That's assuming the regular 4-year BTC cycle keeps it up, and that we haven't moved into the supercycle that accompanies mass adoption of BTC as the world's preferred asset class. I think we'e getting there. The ETF explosion earlier this year was one step, the introduction of options on said ETFs this week seems to be doing the trick as well, compounding Trump's election victory. And even better, today SEC chair and crypto nemesis Gary Gensler announced his resignation effective Jan 20th of next year.

Price just hit 99k and I'm almost trembling.

I had to call one of my friends earlier this afternoon. "Are you experiencing the same sort of satisfaction that I am right now?" I asked him. Four years of waiting, eight months in the wilderness, waiting for Godot in a horrible, drawn out sideways price trend, with the US election as the backdrop. And here we are, less than a month since, up another 40% with no end in sight. It's insane.

I realize I'm not doing a very good job with this blog, providing you, dear reader, with actionable insights or whatever. Here in these early days I'm just trying to hold myself together, and get out of my head a little bit. My experience right now doesn't get me out of the house much, save the gym, and it's not like I go around yammering "bitcoin bitcoin bitcoin" to everyone I talk to. I don't have coworkers, or even a team outside of my family right now, and let me tell you, kids are horrible roommates.

I can promise you one thing though, I will not be shilling my bags. I'm not even shilling bitcoin. I think most people who are in, are in, and if you've waited until now and still haven't taken the plunge, then there's not much I'm gonna say at this point that should sway you. Most people aren't built for this shit. Lord knows my wife isn't.

I told another friend that this run feels subdued in a way. This steady climb is remarkable for the sheer price that we're talking about. Coming to 100k is a huge psychological barrier. I remember 10k being the same way. I can't wait for 1m, but I'm getting ahead of myself. All I know is that I'm watching these green candles move ever steadily up toward this milestone, and I'm wondering if we'll see the same sort of history again. In '17 we blew straight through 10k to 20k before things turned around at the end of the year. That was literally 4 years ago to the week.

This time is different, of course, hubris. Will we breach 100k and hit 200 before Christmas? It's possible. But with ETFs and options it's likely, but now we've had another four years of bitcoin to infiltrate the world of finance. Bitcoiners and crypto advocates are in positions of power and there's every indication that Trump, Elon, and other cabinet members are going to let the reins loose, and it seems likely that things will be going bonkers.

But don't take my advice, anon. Don't FOMO in at this stage of the cycle, if you're just getting started, just tuck a bit extra away, or put some ETF in your IRA and start scaling in. Give it a couple years of steady investment before you start min-maxing and hyper optimizing things. Or don't, who am I to say that I have done anything other than taken a huge calculated risk that is paying off. Survivorship bias and all that.

I have to say that I'm feeling remarkably calm this time, with the stakes greater than ever. It's my third rodeo now, almost ten years on of this game. I'm older now, and have perspective, which is the advantage that age has over youth.

What has happened in the past, and one marker that I will be looking at is the bitcoin dominance metric, which usually signals the start of altseason. I've scaled down the amount of stuff that I do with alts, as 95% of them are generally trash in the long run anyways. But at some point during the coming months, you'll see profit taking rolling out of BTC by the smart money, and that will be rolling into everything you can possibly imagine. I imagine that there are a good number of those people playing the memes right now, who are starting to get a good case of FOMO on king corn right now. Retail hasn't even shown up yet. All of this is institutional investment, companies are buying it, as are some countries. And boy, I can't wait to see the price action when that game gets heated up. I don't know if we'll see it in 2025, but it's probably going to be one of those gradually, then suddenly kind of rallies.

I remember nights that I would just hang out on TradingView, watching candles go crazy. TV's crypto chat is usually a circus, but I don't think I'll be staying up late getting drunk and hanging out with the other degens. I've mostly cut alcohol out these days and I go to bed like an old man. But the circus goes on.

Trying to time the market is a bit crazy, there's the need to take profits when things are crazy, but not to do it in such a way that makes one FOMO back in. I've known people that sold their stacks of this or that in one big swoop and then they've had to sit the sidelines while things go bananas. Some people aren't really good at the whole buy low, sell high way things are supposed to work. Usually they lack conviction in what they're buying, and their moods are driven by popular sentiment or price action. Lord knows I've been guilty of that in the past. That's why I always say to have a plan going in, and you damn well better stick to it. There's an aspect of risk management that people don't think about before they go in. They don't dip their toe, they jump right in, then spend all their time worrying about when to get out. They watch the roller coaster go up, and then they try to make decisions while they're overcome with emotion. That's no way to handle money.

We're going to wrap for today. I realized that I need to move another tranche of funds into my Value Averaging vault. It's like a DCA, except I'm buying stablecoins. Now seems as good a point as any to move it around, as I doubt we'll be seeing the north side of 100k this close to the end of tradFi's business day. I'm sure there's some skullduggery afoot, if you will, with spoofs and other nonsense going on as the big players hunt for liquidity, which is a fancy of way that they're trying to liquidate people who have taken on too much leverage.

I hope I'm wrong, but I've got a plan, and I'm damn well going to stick to it through Christmas.