What is reFIREment?

Doing it the blockchain way

For the last several years my wife and I have been following an approach to finance called FIRE, or FI/RE, which stands for financial independence, retire early. We can argue about the retire early part later, for starters, let's talk about the financial independence aspect of things. The general path to wealth centers around purchasing assets, building passive income, and living off the generated gains while never drawing down the principal. That's basically worked for the last one hundred years as inflation and compound interest take off and the generations roll by.

Over the last one hundred years, the average return for stock or index funds is 10%. Inflation has only run just over 3% during that time. So, the general idea is to build up enough assets until the return on those assets are able to provide enough money for those expenditures. For example, let's use a six thousand dollar budget, say $1500 month mortgage, $1500 month healthcare, $1500 groceries, and $1500 for bills and discretionary spending. This is $72,000 year, which is slightly more than the household expenses for my family of four. Note this is expenses, not income.

One's FIRE number is determined by taking annual expenses and multiplying them by 25. If you start with your monthly expenses, just multiply it by twelve first. That number in our example here is 1.8 million dollars. It seems like a lot, but this is what I might consider a lavish budget. A smaller family might need only $4000/month in spending, which is just 1.2 mil.

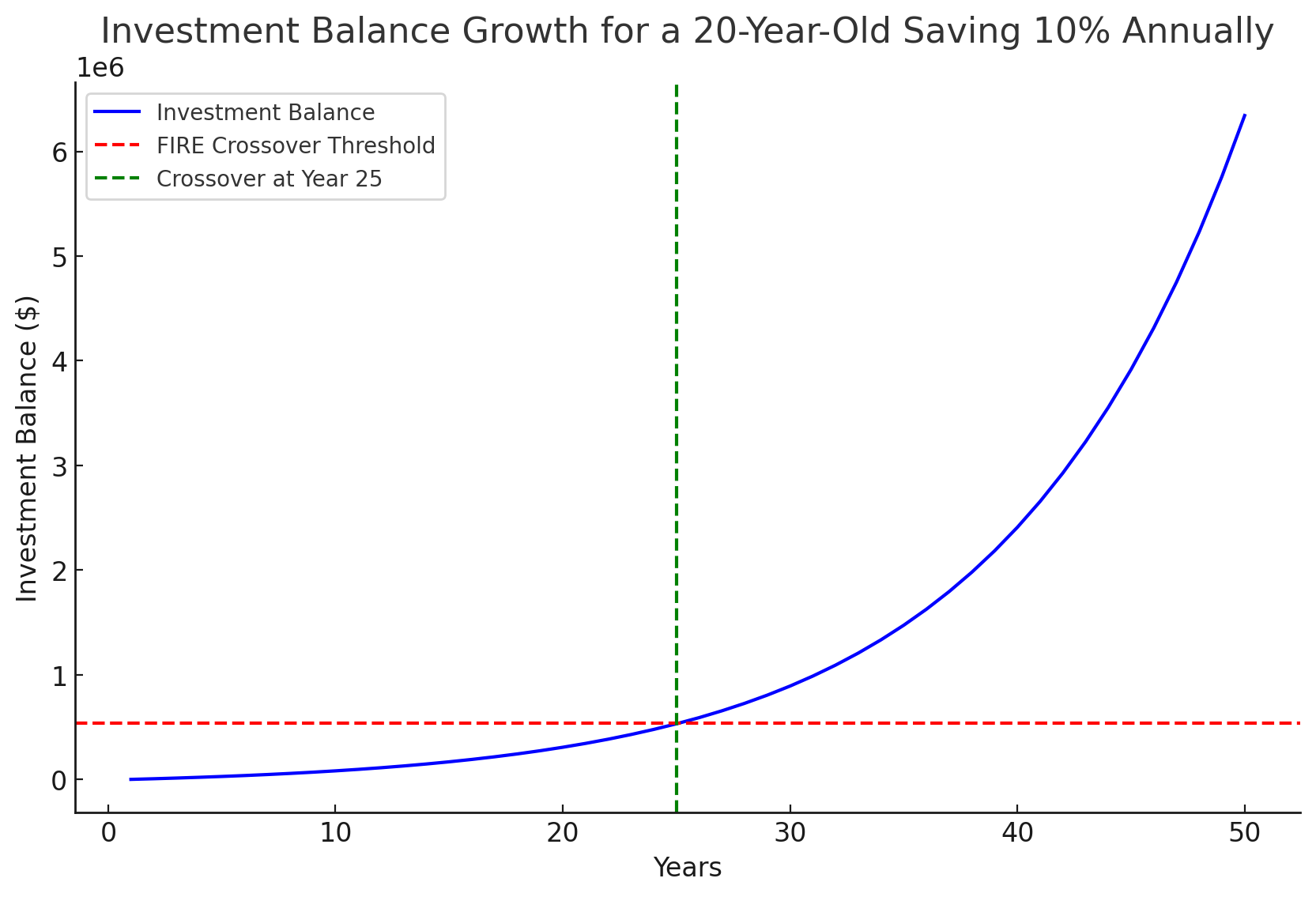

As a proof, let's look at a twenty year old making 60,000. This person saves 10% of their salary in index funds, which averages 10% returns each year. They spend the rest. How long will it take before the investment returns are enough to cover those expenses. All things being equal, it takes twenty five years.

Here’s a graph showing the growth of the investment balance for a 20-year-old earning $60,000 annually, saving 10%, and investing in index funds with a 10% average return. The red dashed line represents the “FIRE Crossover Threshold,” where the returns on investments would be sufficient to cover annual expenses.

From this projection, the crossover point occurs around Year 25. At this point, the returns from the investments meet or exceed the annual spending requirement, marking financial independence by the rule of 25.

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

# Parameters for calculation

starting_salary = 60000 # annual salary

savings_rate = 0.1 # 10% savings

investment_return = 0.10 # 10% average annual return

initial_investment = 0 # starting investment

years = 50 # projection over 50 years

# Annual savings and expenses

annual_savings = starting_salary * savings_rate

annual_expenses = starting_salary * (1 - savings_rate)

# Arrays to store values over time

years_array = np.arange(1, years + 1)

investment_balance = np.zeros(years)

investment_balance[0] = initial_investment

annual_investment_return = []

# Calculate investment growth over time

for year in range(1, years):

# Grow investment by annual return and add new savings

investment_balance[year] = investment_balance[year - 1] * (1 + investment_return) + annual_savings

annual_investment_return.append(investment_balance[year - 1] * investment_return)

# Calculate crossover point when investment returns cover annual expenses

crossover_years = np.array([year for year in range(years) if investment_balance[year] * investment_return >= annual_expenses])

# Plotting

plt.figure(figsize=(10, 6))

plt.plot(years_array, investment_balance, label="Investment Balance", color="blue")

plt.axhline(annual_expenses / investment_return, color='red', linestyle='--', label='FIRE Crossover Threshold')

plt.xlabel("Years")

plt.ylabel("Investment Balance ($)")

plt.title("Investment Balance Growth for a 20-Year-Old Saving 10% Annually")

plt.legend()

plt.grid()

# Show graph and crossover year if found

if crossover_years.size > 0:

crossover_year = crossover_years[0]

plt.axvline(crossover_year, color='green', linestyle='--', label=f"Crossover at Year {crossover_year}")

plt.legend()

plt.show()

Keep in mind these are ideals and averages, individual circumstances may differ and you might be reading this with objections about various factors such as circumstance and socioeconomics, and I will just nod my head and say yes, yes, of course you're right, but this is the path that has worked for me, through unemployment and homelessness and running a business and working corporate and getting married and having kids. All the ups and downs. People can make excuses or you can just do what needs getting done, but if you ain't paying your future self first then you need to stop right there and fix things first. I'm hoping that you're not as old as me and waited too long to get started, because you got a long, hard road ahead. There's gonna be more pressure to catch up, which is going to make you take more risk, and that's the worst, because the number one rule in this game is preservation of capital.

Now, personally speaking, the ten percent return in the above code is what you might call passive income investing. Just purchase mutual funds and wait. Of course the problem with doing this through traditional retirement accounts is that you can't draw on them until you're in your sixties. It's really hard to put that in perspective when you're young. My plan coming up was to max out the employee match in the 401k, or later, the max in the IRA plan, and then put another bit toward a regular brokerage account for my 'gambling' money. Even then, the danger was not having a plan, and bailing on a position before it had time to play out. We're talking long-term plays that take years to pull through.

Venture capital fund managers might take a spray and pray approach, where they put 100 bets out there with the goal of 95 of them failing, 4 of them breaking even, and one of them blowing up 100 fold and making all their money. Jason Calacanis likes to talk about how he scored big on Uber, well, back in my day it was FAANG before it was a thang, if you will, so I made out pretty well. My point is that kids these days can do much better than 10%, but they still need the basics in place before they go down that road. The whole meme-stock thing last cycle was a bad thing, and was too close to the casino side of crypto than was comfortable for me. I don't buy lotto tickets, and I try to have plans about what I'm doing, stick to what I know, and don't speculate. There have been exceptions to these rules, but you know the saying that you have to be around long enough before you know which rules you can break.

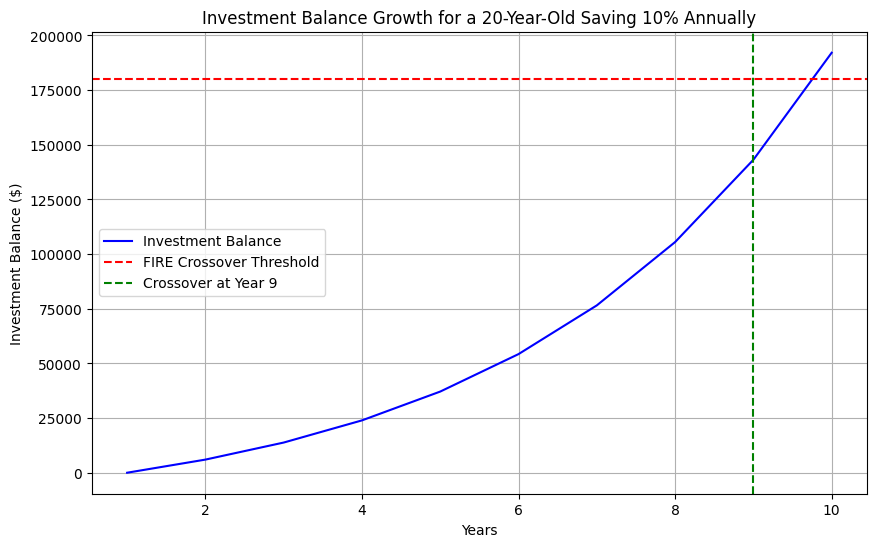

Over the last eight plus years, according to analysis of my crypto wallets, I've maintained a 30% average rate of return. It's higher than that, as it doesn't account for money I've pulled out over the last couple years. Let's revisit that graph from above with a that return.

The cutover here looks weird because the code breaks it at year nine, instead of closer to year ten. The amount here is $180,000, which is actually a bit higher than the my actual cost basis.

Now sure if it was easy anyone could do it. I'm not saying that you're gonna get thirty percent over the next ten years in bitcoin or any other investment, the point here is just to put some perspective on the general plan. Are you paying attention? Are you paying yourself first? Start there before you worry about the rest of the details. Consider that ten percent a tithe to your future self. Drill it into your kids. Just fucking do it.

Now, a bout that back half of the FI/RE equation, the early retirement. Surely I don't expect to just sit around for the next three or four decades, drawing off my savings and waiting to die. For me, retirement means escape from the rat race, corporate bullshit jobs, and dealing with failing bureaucratic institutions. Spending time with my family, pursuing my interests, and participating in my community in the way that brings me the most ikigai in life. Waiting until I'm sixty or seventy years old to actually live my life, only too find my golden years cut short due to neglected health, is not the way.

Anyways, you can wait to figure out what your retirement looks like, it takes time anyways, the important thing is to focus on building the foundation.

It's been hard for me the last two years, getting laid of during crypto winter, and basically holing myself up with my family, trying to keep up with some form of continuous learning. The past six months have probably been the hardest, but now that the 2024 bull is in full swing, I feel vindicated, born again almost. (Beware hubris.) The plan is paying off, and now it's time for me to start moving on to the next step, which is to diversify into real world assets, namely real estate and business ventures. Bitcoin is generational wealth, and I'm fortunate enough where I feel that I am not only setting myself up for the rest of my life, but my children as well. How can I not try to share that?

I'll be documenting my experiences here in the coming weeks, for better or worse, and will go into additional details as to how I made that happen. I'm more than happy to share more details if you want to leave questions in the comments, and I'll address them in future posts. My immediate goals are to purchase a used car, then explore options options for part time work while I fund my new business venture. The idea is to fund a DAO with a bitcoin treasury and find a way to use that as collateral to fund business operations. The current lending/borrowing landscape is pretty high for collateralized loans, around 11% as I write this, which I consider way to high, but selling bitcoin has its own opportunity cost. We'll get into all those details another day.

If you've enjoyed this post, please subscribe, and thanks for reading. We'll see you next time.